The accounting industry, like any other industry in the digital age, needs to keep up with current practices, and one of the easiest ways for you to do this within your accounting practice is to implement new technology.

Technology in the accounting world can help decrease human error and improve your services all around. With accounting practice automation software available, tedious jobs can be done by a computer, giving you time for the stuff that really counts.

But how do you go about introducing advanced technology to your accounting teams?

Below, we’ve offered guidance on how to introduce new tech to your accounting professionals and how to overcome any hurdles you might face.

Analyzing the Need for Technology in Your Accounting Practice 🧑💻

Source: TrustRadius

In the modern accounting profession, technology is an absolute must. No longer do accountants use pen, paper, and an abacus to help you deal with financial records and your accounts receivable; instead, they use technology that automates the processes.

But what are the benefits and uses of technology in accounting?

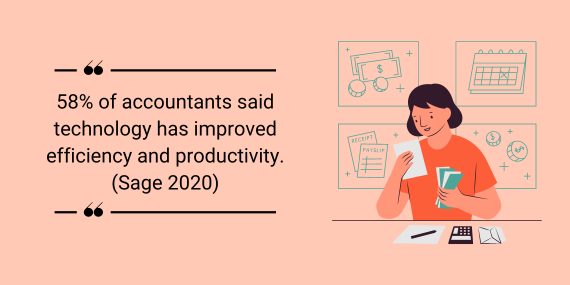

- Efficiency and time-saving: One of the most obvious benefits of automation in accounting is the way it helps accountants save time. If time-consuming daily tasks are automated, they’ve got more time for other stuff.

- Accuracy: Humans often make mistakes, and this can cause issues when it comes to your financial information. Fortunately, the use of accounting software can reduce errors and improve overall accuracy in your financial reports.

- Access to real-time data: Using cloud computing solutions and remotely accessible tech can mean accessing real-time financial statements quickly. This makes informed decision-making easier and allows flexibility and collaboration in your team.

- Security and compliance: Due to the sensitivity of financial data, it can be difficult to ensure your practice is compliant and secure without the use of advanced tech.

- Improve client relationships: Using accounting software can also improve communication with clients and even offer value-added services, like personalized reporting.

Introducing Technology Into Your Accounting Practice 🧾

Introducing things like artificial intelligence and new software to your team can be difficult. Firstly, because learning how to use it takes time and energy, but also because people may feel the technology is about to take over their jobs!

Do your best to reassure them, and then look at the steps we’ve listed below for introducing new tech to your accounting firm.

1. Assess your Current Processes 📈

The first thing you need to do is look at how you’re currently doing things. By doing this, you give yourself the opportunity to see where you’re not working as efficiently as you could be. Look at pain points and areas for improvement in relation to the specific needs of your business and the clients that you serve.

Source: TrustRadius

When looking at your processes, consider how long things take and where employees may be feeling more stress. Do certain daily tasks take lots of time and appear frustrating for staff? Could you do something about these issues?

While not always the main reason for implementing new tech, you might find that new software actually improves workplace culture by reducing employee stress!

2. Choose the Right Technology 💾

There is a ton of accounting software out there. Way more than you will have time to look at, so instead of checking it all out, look at what you actually need. Are you looking to automate invoices and workflows? Do you want to give clients access to their cash flow in real-time?

Once you know exactly what you want the tech to do, you can narrow down your search and find products that actually work for you.

You might benefit from reading user reviews from other accounting firms or, indeed, asking colleagues in the industry which products they have found most useful and why.

3. Invest in Training and Skill Development 💸

The new technology or software you invest in will likely require training for your team. This might come from the company you purchase the software from, or you might do the training yourself. The key is to ensure that everyone actually understands how to use the software and uses it optimally.

You might choose to train only staff who already have skill sets that lend themselves to this kind of technology. But remember to try not to alienate some members of your team who also want to learn.

4. Ensure You're Meeting Compliance Standards 🤝

A set of accounting rules, regulations, and standards, known as the Generally Accepted Accounting Standards, or GAAP, govern many processes relating to accounting practices in the US, along with other regulations.

As a business, you need to be compliant with such standards to ensure you’re working legally. When implementing new technology, it is imperative that you ensure all your processes remain compliant with the new software.

You might want to work with your legal department or a solicitor to ensure that all aspects of your new processes meet industry standards and regulations.

5. Gradually Implement the New Tech 🧮

Implementing new technology into your accounting firm will always take time. Firstly, so that your team doesn’t suddenly have to learn lots of new processes and procedures overnight, but also so that clients can get used to the upgrades too.

Additionally, introducing new technology tends to be a costly endeavour, with lots of software costing money upfront or in subscription fees.

The best way to implement new tech gradually is to pick the software that is going to improve procedures the most. Start with this piece and spread training and skill development out so that your team has time to learn the new processes and get used to the tech.

You could lay a road map that is shared with the team and illustrates how and when new features, procedures, and software may be implemented over a period of time. This gives your employees all the information they need and gets them ready for the upgrades.

You may also want to illustrate the benefits of these introductions, like helping to reduce their stress and improve their efficiency to get them excited about the new processes.

While the benefits of implementing new technology might make it tempting to implement it all in one go, doing so could lead to a lack of training or people growing overwhelmed.

6. Monitor and Measure the Success of the Implementation 📏

The best way to be sure of your investment and to track its success is to establish key performance indicators. These KPIs should be monitored continuously so that you can gain insights from your data and make changes where necessary.

The data you collect will show you whether or not the technology you have implemented is actually having an impact on your efficiency and productivity as a company and whether it is enhancing services or not.

You should also get feedback from your employees to find out how they are finding the software. This could give you insight into whether further training is needed as well as how they think the tech works alongside your services.

Monitoring the success of these technological investments is key to ensuring that your investment is worth something. It can give you an ROI rate and help you decide where else you may implement new technology to improve your services.

Overcoming Challenges When Introducing New Tech to Your Accounting Firm 👊

Introducing new technology to your accounting firm is always going to come with a few hiccups. Below, we’ve explored a few common areas where accounting firms may run into problems and how you can go about overcoming them.

- Fears associated with new technology: Sometimes, people who have been in the accounting industry for a long while may feel that they don’t need new tech. They may think that implementing automation actually takes away the necessity for their job. You can reassure them by explaining how automating certain processes gives them more time for new clients and projects.

- Training problems: Some people may be averse to learning new skills and training in new procedures. They may feel that the old ways work perfectly fine and not want to put time into learning new methods. You can overcome this by laying out the benefits of the new software for your company and for them personally.

- Client fears: Clients may feel overwhelmed if you suddenly pile lots of new tech onto them, but by moving gradually and explaining how these implementations can actually benefit them by improving your services, you can bring them around.

- Budgetary concerns: Introducing new tech will always cost money. Whether you pay for new software upfront or on a rolling contract, you may need to convince investors or managers that this upfront cost is worth it. You can do this by showing them where you will be able to save money by implementing new software. You will also be able to give ongoing reports of money savings by monitoring KPIs’ tracking efficiency.

Conclusion

Introducing new software in any industry can be difficult. It involves not only finding the best software for your company but also retraining and investing in skills development. However, in the digital age, things like automation and efficiency are paramount if you want a competitive edge.

You can follow our few steps to introduce new technology and hopefully see really positive changes in your accounting practice!